Edward Hugh is obsessed mainly with Spain – and Spain is the big picture – but the markets are obsessed with Greece. Greece is ground-zero in the Euro-zone implosion. At ground zero is a bank – a surprisingly nice bank – the National Bank of Greece.

Most people are not like me. They don’t read bank balance sheets for fun. So let me hold your hand and I will take you through it so I can ponder a few imponderables about Greek default…

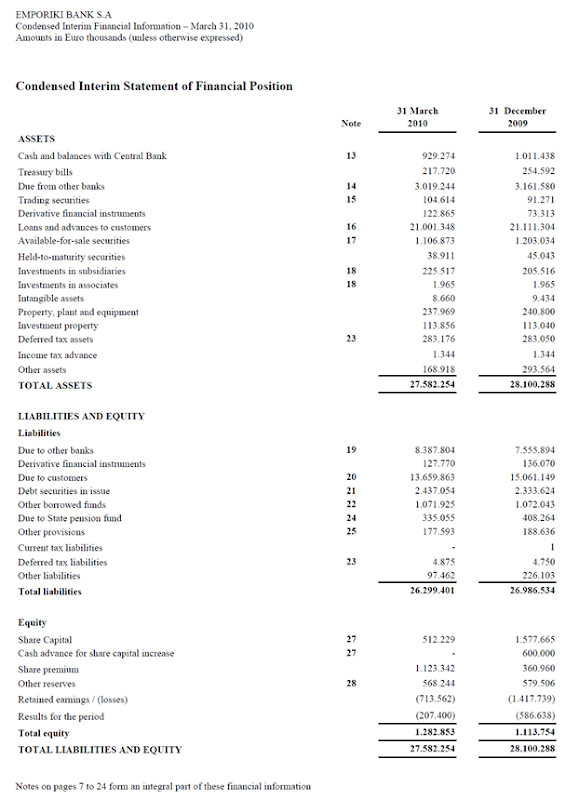

Group in this case includes the subsidiaries in former Yugoslavia and other places. Bank represents the bank in Greece. The core thing to notice is that the loan deposit ratio is roughly 100 – maybe just a little over 100 but not extended. Also Bank (ie Greek) loans are under 60 billion euro – small relative to the economy of Greece (maybe 300 billion euro counting a black economy). This bank is simply not over lent.

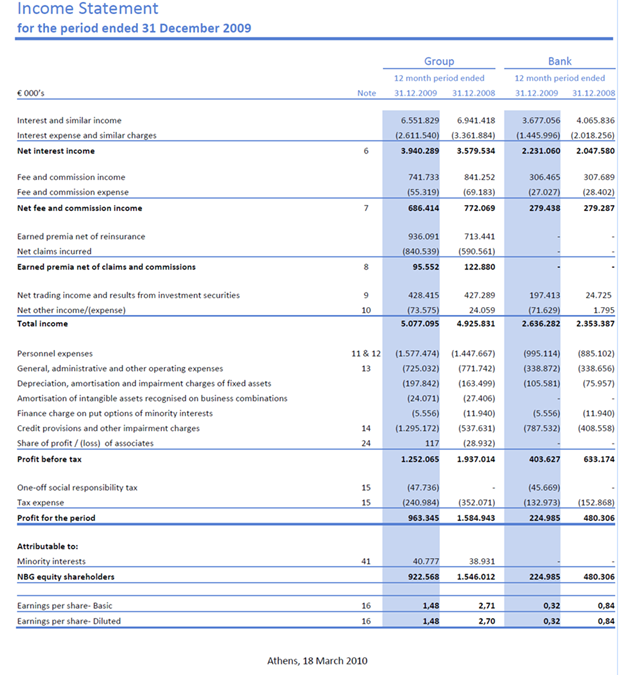

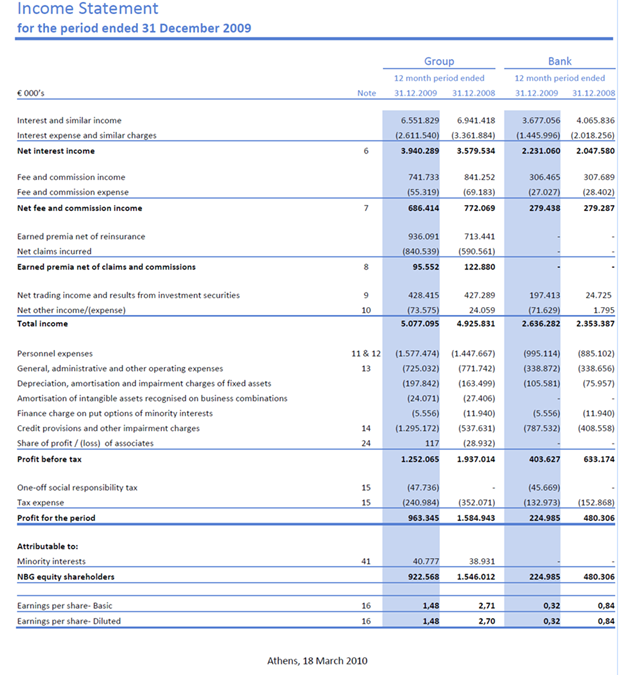

Growth rates are just under 10 percent per annum – but for most of the cycle growth rates were lower. This is important because a fast growing loan book can hide a lot of problem (by extending more credit to people who cannot pay). There is little evidence that the National bank of Greece has been doing this though I would be more comfortable with a lower growth rate in good times – but it is as it is.

Secondly the bank is surprisingly profitable. It has interest spreads and costs commensurate with the great oligopoly banking systems of the world (Australia, Canada, Scandinavia, regional France). The Group remained profitable in the first quarter – though the Greek parent had become slightly loss making.

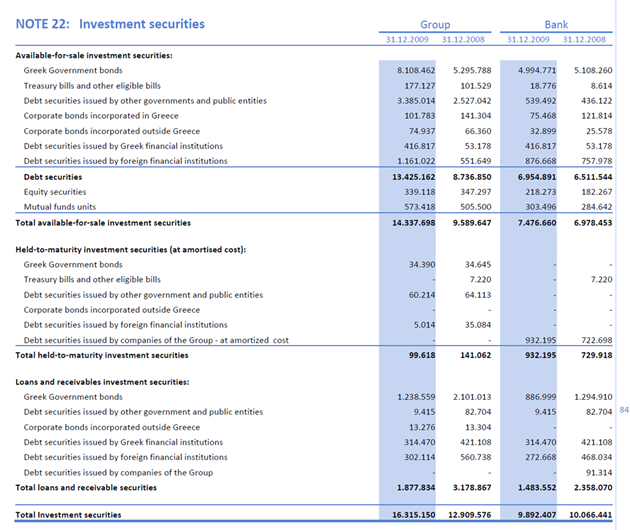

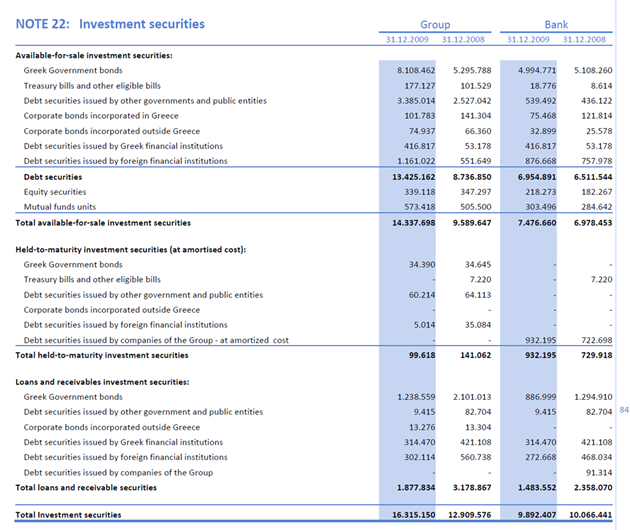

There really is only one big problem with National Bank of Greece – and that is Greece. Lurking in the balance sheet you will see about 20 billion euro of “due-to-banks”. This is interbank funding due to other European banks (presumably German). Offsetting this is about 16 billion in investment securities. Note 22 covers those – and they are mostly Greek Government Bonds – and if they not “Hellenics” then they are credit conditional the Greek Government anyway… For masochists the table is here:

Take the investment securities away – and throw in the deep recession that is likely if the Government defaults – and it is pretty hard to see how NBG gets out of this.

The last quarterly conference call was one of the saddest things I have ever listened to – because the management seemed – certainly by the standard of regional bankers – to be a very fine group of individuals. They ran a darn tight ship – a bank that should be OK and indeed I quite like. Certainly NBG is one of the better run banks out there. Most of the conference call was about running day-to-day banking and how you operate in what is a very tough environment. That of course was the one credit that they could not “manage” – the local Sovereign. And the management stated that they were “the best credit in town”. This line is a paragon of wishful thinking.

Alas if Greece defaults it looks likely that NBG goes with it – as would any other Greek bank (except probably Emporiki where the losses will be borne by Credit Agricole).

In delay there lies no plenty

Shakespeare asserted that in delay there lies no plenty – and that is most certainly true if you need to fund the National Bank of Greece.

If you were a Greek rich guy with substantial deposits what would you be doing? Short answer: run at par. You can get out at par something that is ultimately credit risk Greek Government without any penalty.

Deposits are falling in Greece. Not a lot – but the fall in the first quarter results was just under 2 billion euro. This is not seasonal… Rich Greek guys of course know about capital flight (they have done that before) but they are only doing it a little – indeed it surprises me that there are not violent runs happening... [contra possibility: the rich guys were never in Greek banks at all…]

The strange shift in the due-to-banks and other balance sheet items.

Obviously the run –small though it is – needs to be funded. Cash was down (no surprise there). The rest is strange…

The due to banks is up about 5 billion in the quarter. I would have thought by the first quarter people knew not to extend further credit to NBG.

Does anyone know who is funding this? Is it all ECB or are the Germans just walking further out on the plank? Is it possible that NBG is buying Hellenics at a big discount to par and funding themselves by pledging the same bonds to the ECB at close to par? The investment securities rose during the quarter - which is similarly strange – and portends the bank buying securities at a discount and pledging them to the ECB at par.

If you want the quarter balance sheet it is below…

Is sovereign default without bank default even possible?

NBG is a good bank. But if the Sovereign defaults it is in deep trouble. Sovereign default will mean that NBG cannot pay back its interbank obligations. None of this should be a surprise to anyone watching the stock price. NBG has not been a good stock. The German banks will lose not only on their holdings of Greek sovereign securities but on their NBG inter-bank funding as well – again demonstrating the adage that if I lend you $100 and you can’t pay you have a problem but if I lend you $1 billion and you can’t pay I have a problem.

This however answers you the question of what a sovereign default has to look like. A straight Sovereign default will bankrupt all the key Greek institutions (even when well managed). And the only way to save them is to allow them to default at the same time without triggering a liquidation.

When you have a pegged currency that is easy – which is that you float the currency but legislate (as per Argentina) that all banks are obliged to pay off their foreign debt in Pesos (sorry Drachma) at the old exchange rate. That way the banks are not killed by the sovereign. But it meant that people who left their US dollars in Argentine banks got back crappy pesos and presumably those with Euro in NBG will get back Drachma. To successfully run from the dodgy-peso you had to put the money in a bank outside Argentina. Merely converting to USD was not enough. Even placing those funds with the local subsidiary of a foreign bank is probably not enough. I suspect this will need to happen in Greece too.

I have no idea of how the mechanics of doing this will work when the currency is the same currency rather than just a peg. Bank systems are non-trivial. If anyone has thought through the mechanics let me know. Most people look at this problem and just conclude that “default is unthinkable”. But that reflexive response – effectively deciding because it is difficult we will not think about it - hardly helps. Whatever – the mechanics will be unbelievably complex.

Thoughts please…

John

FTAlphaville makes a very similar point.