Being a fund manager involves many skills. One of the rarer ones is trying to work out what redacted government documents say. The Department of Homeland Security has just completed a large no-bid contract to purchase Relenza – a drug made by Glaxo. It is justifiably a no-bid contract because whilst there are competing drugs they have resistance problems. Relenza has a monopoly over its drug protected by patent. A no-bid contract – even of large size - makes sense.

The Department of Homeland Security have released some details of the contract – but the key lines are redacted. In particular the cost is redacted, as are the number of doses and even the names of the authorising officers.

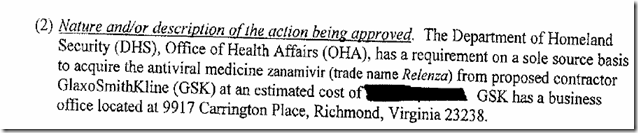

The blacked out number below is highly market sensitive. Help. Please.

Finally I am just a gambler on the stock market. My concerns are private. However you should also be concerned. This is taxpayer money. This is a no-bid contract with limited transparency. I can’t think of any good reasons for blacking out these numbers. If you thought the no-bid contracts in Iraq were a concern (and I did) then you should also consider this redaction a concern. At least in the Iraq case there might have been a security reason for redacting the key information. Here I can’t think of any reason other than it is standard practice for the Department of Homeland Security.

John

16 comments:

Just bend over this barrel and I'll explain to you exactly how the military handles taxpayer money.

Blacking it out just makes it worse. What exactly are they trying to hide? We know they bought it. Now just tell us how much. Holding your hands over the children's eyes only protects them from the world for so long.

Will the company announce the details?

But I suppose by then it will be too late.

"I am not concerned with us all, just myself. And believe me, I shall be perfectly fine. Now, sit, please." Artemis Fowl

Quite possibly the numbers are redacted due to the volume discount the government was able to swing.

Speaking of discounts, just buy the shares.

anon,

Bob Dobb

I took a quick look. It would be best to have as close of a source material as possible (which this is not). It looks like a pixelated blackout, probably fax. It is high contrast and there is no content in the pixels in the blacked out area (I checked). If you want to know what was written there, you either need better source material or you would have to guess the content from the size of the box and the pixels sticking out to the top and bottom. Very dodgy, but maybe not impossible.

There is an attack against blacked out material, but it's more useful for names than numbers.

It was used against the documents which listed the countries which had at any time held American nuclear weapons.

You examine the document font and measure the width of the numerals. You can then figure out a maximum/minimum length value for the content of the blacked out portion.

its at least an 11 figure black out.

so at minimun 10000000000

Better than purchasing shares of Glaxo, buy Glaxo's partners, Gilead Science on the dips.

And hold for the long term.

anon,

-Bob Dobb

john do you think biota is a good buy at this price?

John, the key phrase in the document was "to protect DHS personnel". It's unlikely to be a large order.

Anyway we already know the targeted production capacity of 190M so what is the use of tracking down every order besides improving your google-fu? At best the order is another confirmation point.

Tax payer funding appears to be a stretch for posting. Do you still have a position in Biota?

I figure the order is low 10 figures - say 1.2 billion.

7 percent is 80 million USD or say 90 million AUD. It is material in Biota - but is hardly make-or-break the stock.

--

I sold some Biota up high - unfortunately not enough. The stock owes me nothing. But I thought I was foolish selling it so low when it was $3 so I should think I am double foolish selling it at $2.

Its not so simple though. All of Biotas revenue is USD - so the pricing in AUD is misleading. Think of it as a non AUD stock and the performance is less volatile.

--

It is a no-brainer for Glaxo to buy Biota at $3.50-4 a share. Why? Because they internalise the royalty payment which turns out efficient to them. However it is not so obviously a no-brainer for YOU to buy Biota to that price.

If Lani works out well then Biota is a steal. If Lani does not then Biota merely reflects a good value - a value that could be blown on biotech research.

J

While the US may order that sort of quantity this year the order you linked appears to be for DHS internal purposes.

Great summary on Biota. Congrats on selling some up higher. If GSK really wanted Relenza to be a success then buying Biota would appear to be a no-brainer.

Biota have said they want a deal for LANI first half this year. It would seem likely GSK are taking a close look. However a take-over offre from GSK would be a hard sell to long term Biota holders who still resent GSK.

Not quite the transparency that was promised for healthcare, is it?

There would be no one else able to bid on this as Glaxo is the sole manufacturer and the patents do not start to expire until 2013.

Given the size of the order the government will get a better price than any of the large health insurers. In fact the prices that the DoD negotiates for is usually excluded from "average" pricing used by private industry b/c it is much lower and the drug companies will not give the same discounts to Walgreens, Walmart or anyone else.

Or you can believe it is a huge conspiracy to send British companies a back door bailout.

hi,thanks Capital Market News

Post a Comment